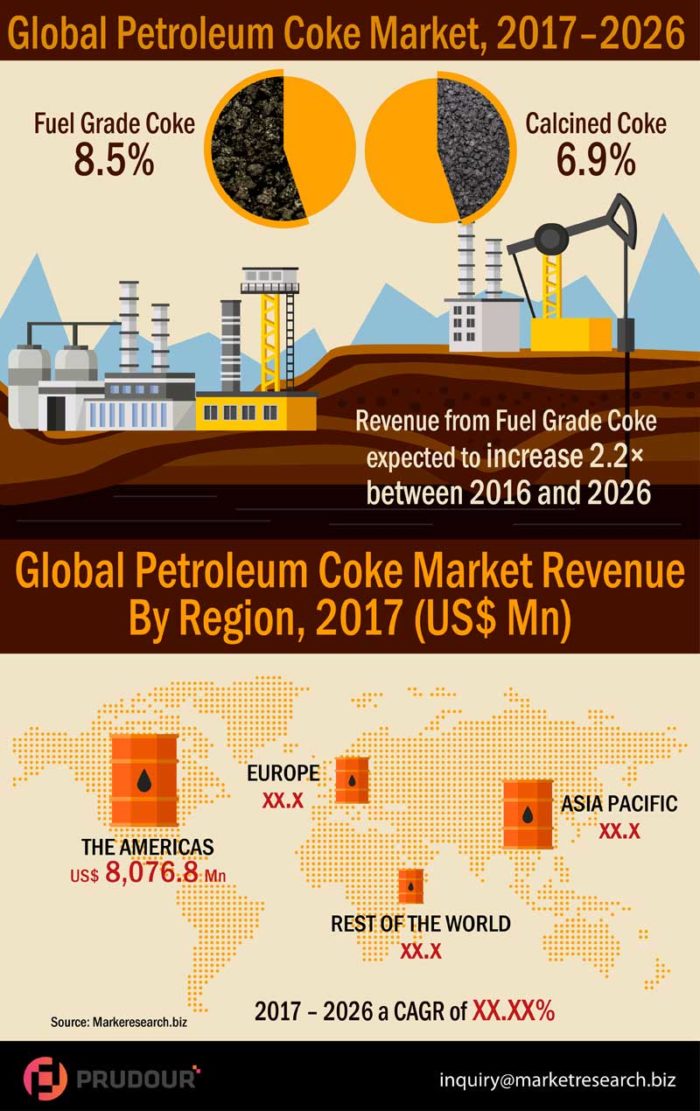

The global petroleum coke market was valued at US$ 16,713.9 Mn in 2016 and is projected to reach US$ 36,236.2 Mn in 2026 at a CAGR of 8.1% from 2017 to 2026. The fuel grade coke segment in the global petroleum coke market is expected to account for the major revenue share of 75.0% in 2017, as it can be used as an alternative to steam coal in various power plants, and its high heat and low ash content makes it an ideal heat source for power generation.

Global Petroleum Coke Market: Segmental Snapshot

By product type: Fuel grade coke segment is estimated to register highest CAGR of over 8.5%, thereby accounting for highest revenue share among the product type segments.

By application: Foundries segment is estimated to account for highest revenue share among the application segments, registering highest CAGR of over 8.8% over the forecast period.

By region: The market in Asia Pacific accounted for second-highest revenue share in the global petroleum coke market in 2016, and is expected to record a CAGR of over 8.4% between 2017 and 2026.

Global Petroleum Coke Market: Competitive Analysis

The global petroleum coke market includes profiles of major companies such as Chevron Corporation, Essar Oil Limited, Royal Dutch Shell Plc., Exxon Mobil Corporation, BP P.L.C, Indian Oil Corporation, Reliance Industries Limited, Saudi Arabian Oil Co., HPCL-Mittal Energy Limited (HMEL), and Valero Energy Corporation.

Infographic by Global Petroleum Coke Market